As a reseller and small business in California, Randy Dreammaker has often said, “Businesses are fleeing California”, now its fact!

SF Gate newspaper published an article today that affirms what many small business and online re-sellers already knew. California is bad for business. It’s also bad for your eyes and lungs, safety, constitutional infringements, extremely high costs for unskilled labor, middle class families, employment, power outages, fires, etc. Take your pick or add your own.

According to the SF Gate article published November 5, 2019, over 691,000 people fled California in 2018 alone. That was prior to the 2019 Massive PGE Power Outages and State Wide Fire Emergencies that displaced multiple thousands of residents in Northern California and to a lesser degree in Southern California.

Other possible contributors is the states impotence when it comes to putting citizens and naturalized residents first, over those who entered the country without legal standing and in violation of federal immigration laws. In 2018, California’s Governor, along with multiple city mayors, multiplied the number of Sanctuary States and legal protections granted to non-US Citizens; created Sanctuary Police Departments and created anti-business immigration laws that penalize businesses complying with federal right to work laws.

In 2019 California Governor, Gavin Newsom and its legislators, passed into law with out public discussion or state registered vote, taxes increases on US California Citizens to pay for the full medical care, free housing, and access to the states welfare and food programs for non-Citizens, despite having over 600,000 homeless US Citizen legal state residents living on its streets.

In Northern California, San Francisco and Oakland passed multiple anti-business laws in 2018 to 2019, including those targeted tech companies, intended on milking them for money to pay for localized social justices causes in the billions of dollars to pay non-profit organizations that supposedly address homelessness.

Homelessness, high costs of living, exorbitant rent and housing are epidemic of poor government, not the responsibility of entrepreneurs, businesses and employers who are a states job creators. Penalizing businesses for the poor local and state wide government mismanagement of course, adds to the fleeing number of wise CEO’s moving their companies out of the state, in desire to maintain or reach profitability.

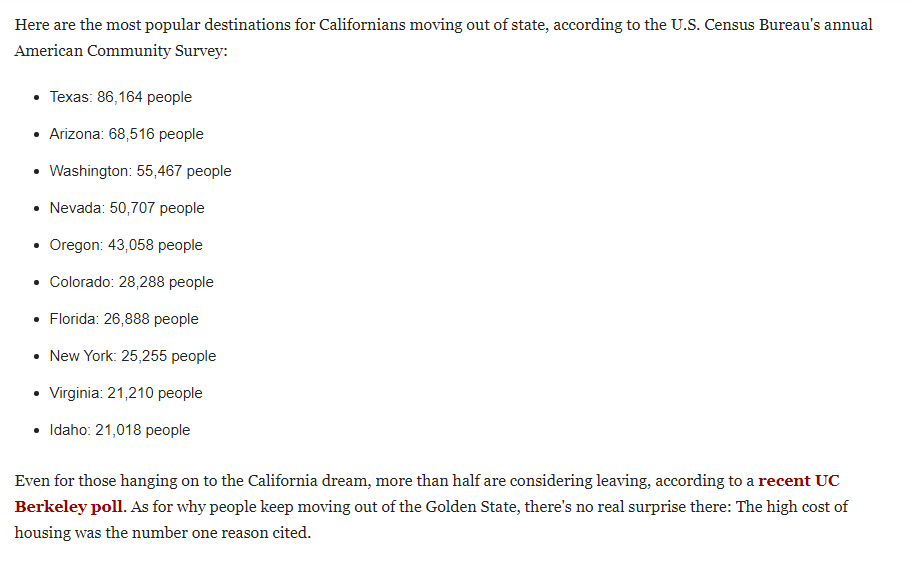

Locations by popularity according to SF Gate.

Regardless of why someone leaves California, Four of the states small business flees to are as follows:

- Texas (Texas is a booming environment for businesses and is business friendly)

- Arizona (Arizona is a welcoming environment for businesses, has better tax laws and is only a state away.

- Oregon (Oregon is a state which attracts many companies fleeing the tech communities around San Francisco. It is the closest neighboring state in northern, California and less hostile towards businesses.

- Florida (Florida has no tax on commerce for brick and mortar retail, nor online sales.

One final thought about why small businesses are joining larger businesses, individuals and families in fleeing California is centered around California’s new state tax laws on internet marketplace facilitators.

In 2018 and 2019, California implemented taxation on all internet sales whether a student trying to recover the enormous $100+ price per college book, or the stay at home mom, selling off her old prom dress to make a few dollars to help around the house. California’s new online marketplace facilitator laws require websites and apps like eBay, Mercari, Etsy, Poshmark and others to collect sales taxes on all sales into and out of the state. At 10.25% average internet tax, California is one of the highest tax states in the USA. That means a re-seller on one of these marketplaces incurs a massive disadvantage compared to a re-seller in a state like Florida where internet sales are not taxed. Why would a shopper want to buy a previously owned product at a 10.25% higher price for from someone in California, when they can buy it from a competitor in 48 other states? They wouldn’t, and they’re not. California online marketplace sellers are quickly beginning to see the significant impact of California’s new sales tax laws with declining sales and profit losses.

In a YouTube video, Randy Dreammaker discussed California’s Department of Tax and Fee Administration recently published new tax rules for those selling on eBay, Mercari, Poshmark and other marketplaces. Some sellers within the state will no longer need a free seller permit, however many California Cities do not recognize the new state law definitions for internet resellers and still force those individual internet sellers to obtain a City Business License which can cost up to $280 a year for a sole proprietor.